how to pay taxes instacart

Wages of 50271 and. By early January 2022.

What You Need To Know About Instacart Taxes Net Pay Advance

If you owe more than 1000 in taxes for the year and do not pay taxes quarterly youll be hit with a late payment penalty by the IRS.

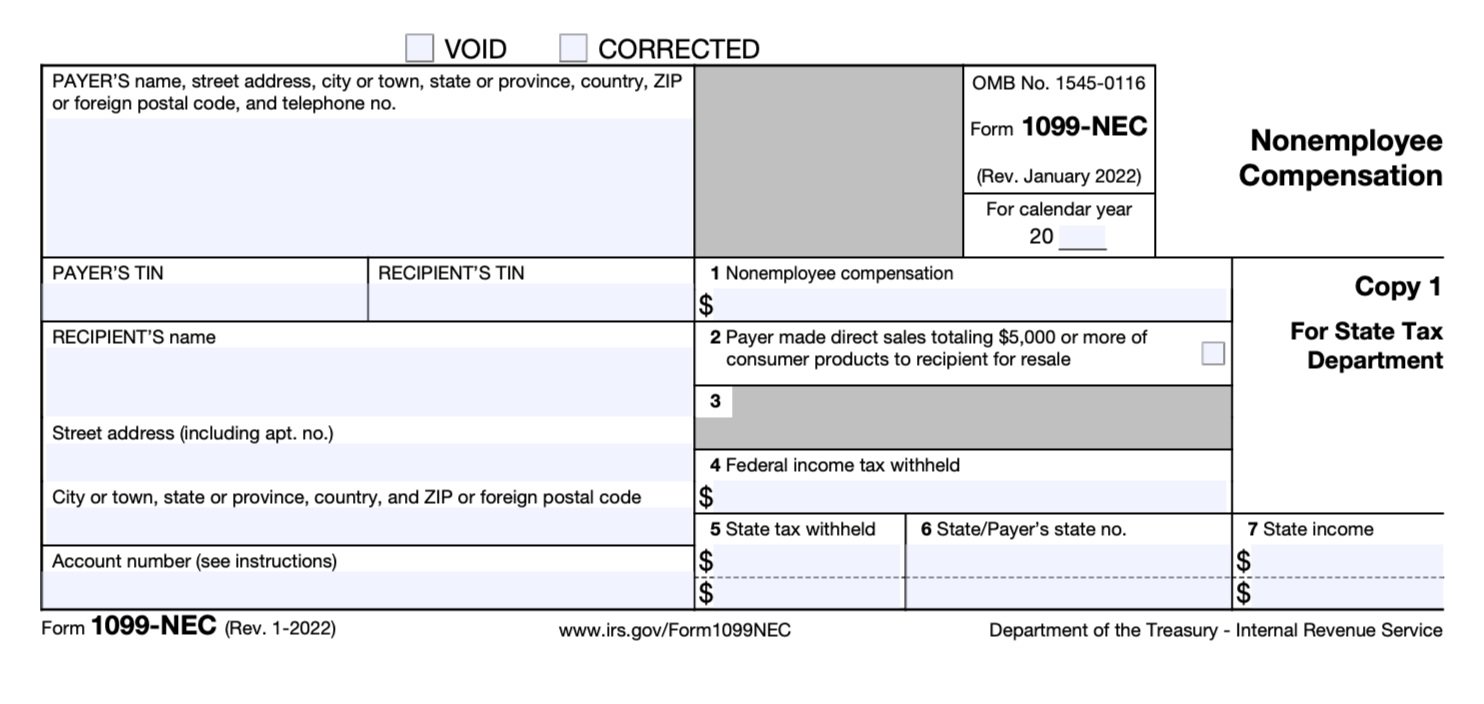

. The Instacart 1099 tax forms youll need to file. If you do Instacart for extra cash and have a W. Tax Deductions You Can Claim As An Instacart Driver.

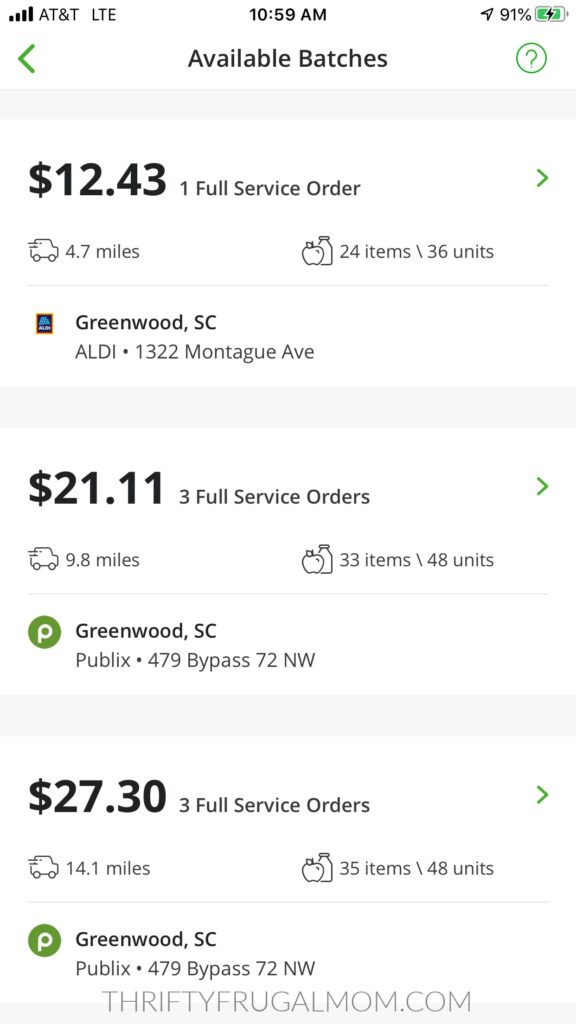

The IRS says businesses are required to file a 1099-NEC form for workers who they paid more than 600 throughout the year. At the top left click the 3 horizontal lines. As of July 14 2022 the minimum pay for full-service drivers ranged between 7 and 10 per batch.

At the same point the minimum pay for delivery-only drivers was 5 per. Pay Instacart Quarterly Taxes. These pay stubs are used while filing taxes applying updating loans and information and applying for a mortgage or low-income benefits.

Yes even as an independent contractor you are to report your earnings from working as an independent contractor at a 3rd party delivery driver Instacart UberEats. Full-service Instacart shoppers who. To add a payment on the Instacart website.

Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. Paper forms delivered via mail may take up to an additional 10 business days. To actually file your Instacart taxes youll need the right tax form.

Customers who use Instacarts full-service options will not receive pay stubs in the mail but Instacart has made it easier to track earnings in the app. Up to 68 cash back Here are a few solid facts about Instacart driver pay that should give you a good idea of what you might earn while delivering. Note that this income was previously reported.

This includes self-employment taxes and income taxes. The organization distributes no official information on temporary worker pay however they do. Answer 1 of 4.

Knowing how much to pay is just the first step. You file 100 - 50 50 of income instead of 100. Instacart Q A 2020 taxes tips and more.

To pay your taxes youll generally need to make quarterly tax payments estimated tax payments throughout the year. To file your quarterly taxes youll need to. Learn the basic of filing your taxes as an independent contractor.

Illustrated with numbers. The UK is set to introduce road taxes on electric cars from 2025 Chancellor of the Exchequer Jeremy Hunt said ending an exemption that was. Being classified as a business owner allows you to deduct your business-related expenses and avoid paying taxes on your 1099.

You can add payment methods at any timebefore after or while placing an order. Accurate time-based compensation for Instacart drivers is difficult to anticipate. The first step of the Instacart shopper taxes is to calculate your estimated taxes and.

The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store. You spent 50 on a durable bag to help you carry stuff. On earnings between 12570 and up to 50270 you pay the basic income tax rate of 20.

Your 1099 tax form will be sent to you by January 31 2022 note. Depending on your location the delivery or service fee. Previously the shoppers used.

For one thing your tax situation will actually vary depending on whether youre an in-store. You make 100 as an Instacart Shopper. Tax tips for Instacart Shoppers.

16 hours agoIf you earn 12570 or less you currently pay no income tax. How taxes work for Instacart shoppersInstacart taxes can get pretty complicated. If you have questions.

How Much Money Does The Average Instacart Shopper Earn Per Day Quora

Can Someone Help Me With The Pay Why Are My Weekly Earnings Not In The Cash Out Amount Just Started Using Instacart Again I Don T Remember It Being This Confusing With The

What Is A 1099 Nec Stride Blog

How To Become An Instacart Shopper Pros Cons Pay Job Application

Guide To 1099 Tax Forms For Instacart Shopper Stripe Help Support

What You Need To Know About Instacart 1099 Taxes

How To Get Instacart Tax 1099 Forms Youtube

Be An Instacart Shopper Instacart Shopper Pay And Instacart Driver Info

File Instacart On Taxes Tiktok Search

1099 Taxes For Gig Workers Explained Expert Advice For Independent Contractors 2020 Instacart Youtube

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart In California Every Other State R Instacartshoppers

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Driver Pay How Much Does Instacart Pay Shoppers

How Does Instacart Work And How Much Do The Fees Really Cost The Krazy Coupon Lady

What You Need To Know About Instacart 1099 Taxes

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

Instacart Taxes How Taxes Work For Instacart Shoppers 1099 Cafe