accounting services tax deductible

Tax accounting support related to acquisition and dispositions. For business owners this means you can deduct the amount youve paid.

Taxes Clipart Tax Deduction Townsend Income Tax Accounting Service Hd Png Download Transparent Png Image Pngitem

Are tax preparation fees deductible.

. Tax provision calculation support. 24500 but less than. That means theres still time to benefit from tax.

Even if your business tax. Less than 24500 the tax is 58 of Maine taxable income. Specifically allowable expenses include.

For the most part yes. 25th November 2020. Tax accounting services include.

Best for overall cloud accounting software. Why Work with An Accountant for Tax Preparation. Ad Discover Helpful Information And Resources On Taxes From AARP.

Up to 25 cash back Legal and accounting fees that you pay to start a business are deductible only as business start-up expenses. Generally tax prep fees are no longer deductible for most people. You may ask.

Tax deductions related to accrued expenses can be difficult to understand. Deductions can reduce the amount of your income before you calculate the tax you. The temporary 100 deduction for eligible business meal expenses remains in effect through December 31 2022.

However you can get preparation fees deductions if you. Planning is the key to. Ad We Provide Accountant Professionals that Creates Value for Your Work.

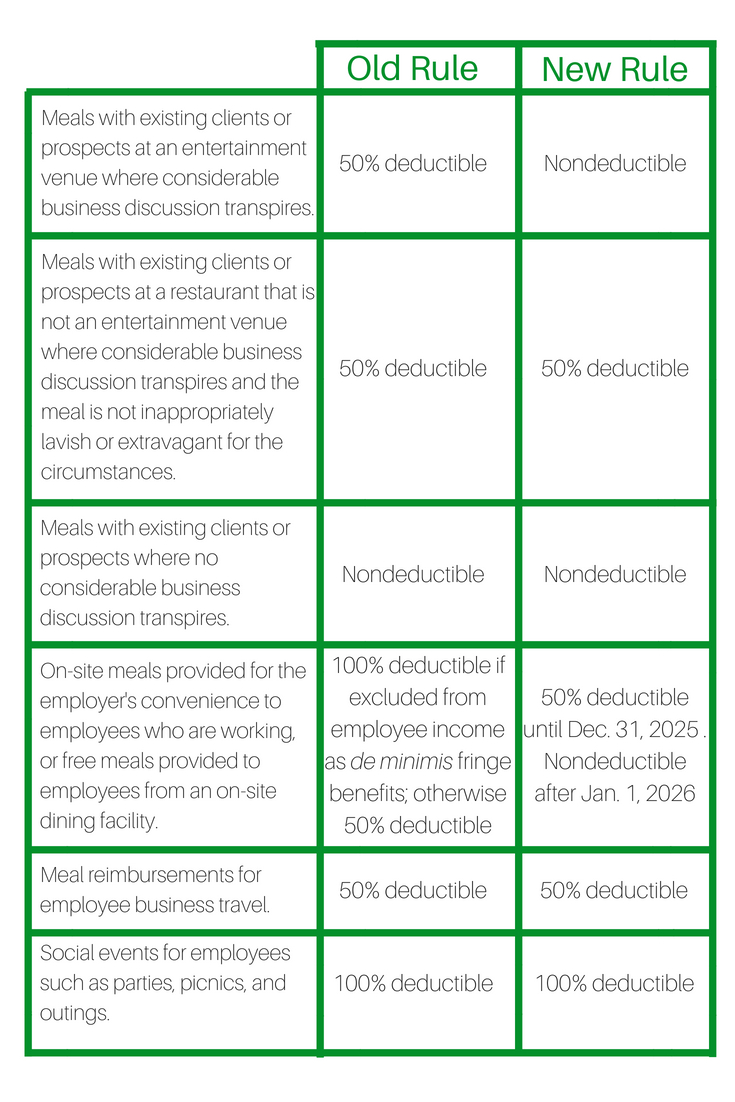

Check For The Latest Updates And Resources Throughout The Tax Season. Best for multiple users. 115-97 Tax Cuts and Jobs Act changed the rules for the deduction of food or beverage expenses that are excludable from employee income as a de minimis fringe benefit.

IRS provides tax inflation adjustments for tax year 2021. Its important to determine your eligibility for tax deductions and tax credits before you file. The short answer to this is yes.

Ad Make the World Your Marketplace w Aprios Intl Tax planning Services. You can deduct 5000 of start-up expenses. The short answer to this is yes.

We are not only known for income tax preparation but for also tax planning and consulting services. Three qualifiers of accrued expenses that need to be met before deductibility can be achieved. For purposes of the 25 limit you dont need to include incidental costs that dont.

If youre just starting a business any accounting fees are deductible solely as start-up expenses for your business. The rest including the standard deduction personal deductions and credits fall into personal expense. For single individuals and married persons filing separate returns if the taxable income is.

Transaction Advisory Services For International Mergers And Acquisitions. For example you cant deduct 300 for two hours if you normally charge 150 an. In summary all employees who claim residency or physically work in a state that levies an income tax will have state andor local income taxes withheld from their wages as required by law.

The HMRC allows companies to claim a tax deduction for some fees that your accountant charges. A business can only claim a tax deduction if the expenses are wholly and exclusively incurred in the production of income. Learn about the impact to homeowners that the recently passed state and local tax deduction limits will have including tax planning considerations - Selden Fox - Chicago CPA Firm.

Tax Planning and Tax Consulting Services in Chicago IL. If you make gifts to customers and clients the gifts are deductible up to 25 per recipient per year. Some may only be partially deductible.

WASHINGTON The Internal Revenue Service today announced the tax year 2021 annual inflation adjustments for more than. Accounting costs for your business can be claimed as a business expense. But you might be able to take deductions for certain qualifying expenses on your tax return.

Best for a diverse range of solutions. Not all expenses are tax deductible. Professional services like Xendoo are 100 tax deductible.

In the first year of business youll be able to deduct 5000 of.

Investment Expenses What S Tax Deductible Charles Schwab

Is Angel Investing Tax Deductible

The Tax Cuts And Jobs Act New Meals Entertainment Rules

Publication 587 2021 Business Use Of Your Home Internal Revenue Service

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

75 Items You May Be Able To Deduct From Your Taxes

Tax Deductible Purchases You Might Not Know Luxa Tulsa Payroll Services Tulsa Ok

:max_bytes(150000):strip_icc()/tax-preparation-prices-and-fees-3193048_color2-HL-8b4b5382e1a44aa0864ed504d4ca5414.gif)

Who Can Still Claim The Tax Preparation Deduction

Are Vacations Tax Deductible When Combined With Business Travel Accounting Freedom

Engineered Tax Services Nation S Premier Tax Credit And Incentives Firm

Tax Deductible Travel Expenses For Business Accounting Freedom Ltd

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Hairstylist Tax Write Offs Checklist For 2022 Zolmi Com

1st Choice Tax And Accounting Services Did You Know Face Masks And Other Personal Protective Equipment To Prevent The Spread Of Covid 19 Are Considered Deductible Medical Expenses Here At 1st

Startup Costs Book Vs Tax Treatment

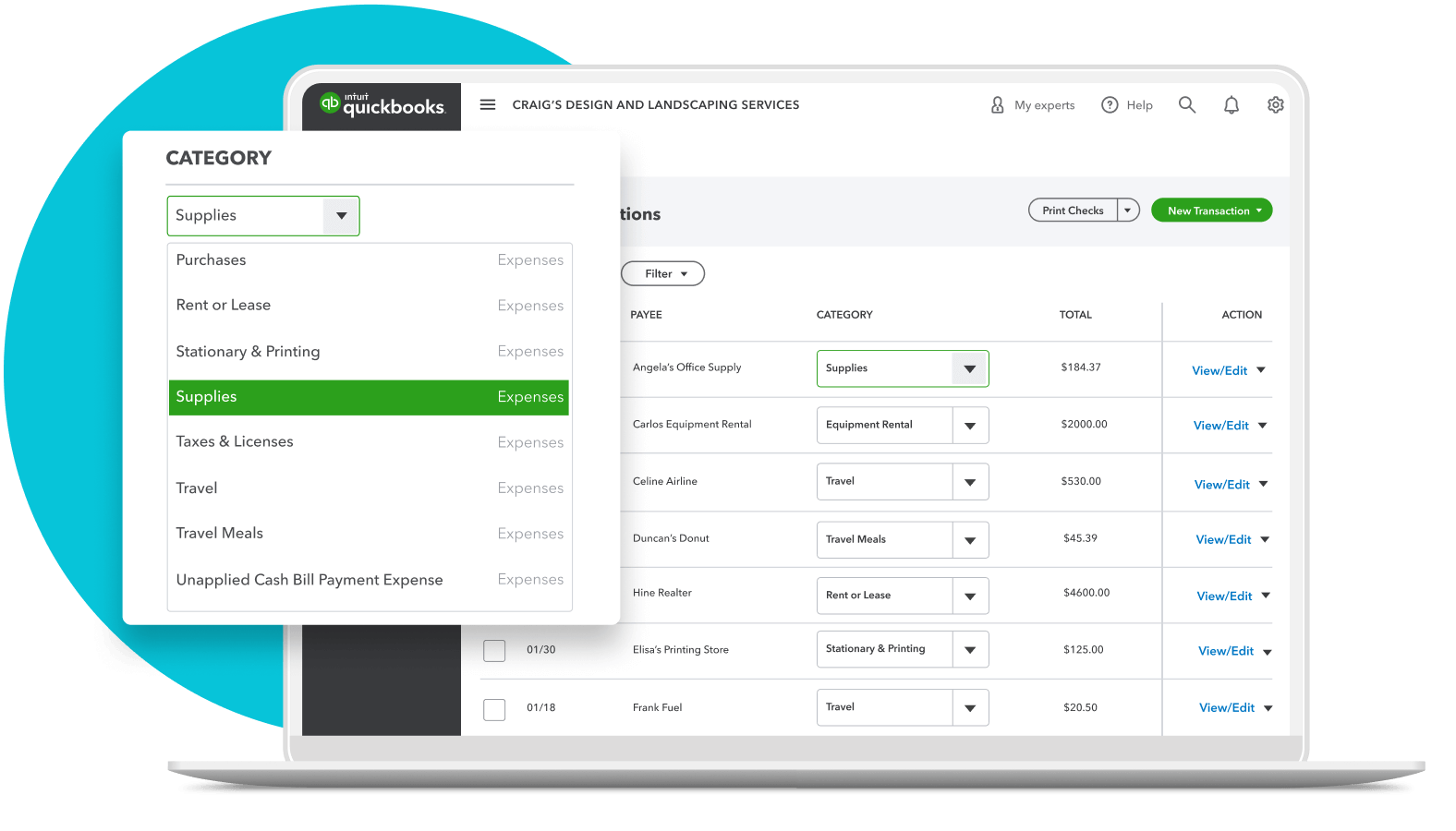

Maximize Business Tax Deductions Quickbooks